By Pedram Tadayon, CEO of Mitigram

Date: 22/07/2025

Tariffs and tensions may be reshaping trade routes, but digital solutions are critical to how businesses capture new opportunities in times of uncertainty.

Global trade is at a pivotal moment. A crossroads where uncertainty, driven by tariffs and shifting economic relationships, is creating both challenges and opportunities. Historically, disruptions in trade have always paved the way for innovation. Today, companies are exploring new markets and partners, largely on the back of strained US-China trade relations. The rise in tariffs has prompted businesses, especially Chinese importers and exporters, to seek new trade routes and partners in regions like Southeast Asia, Latin America, and Europe. In a recent Mitigram webinar, Steven Zhou, Executive Director at TradeGo noted that this isn’t a temporary reaction, but part of a broader restructuring of global trade networks. From Brazil’s soybeans to Vietnam’s manufacturing hubs, new relationships are forming.

Global trade is navigating an era of deep disruption. From escalating tariffs to evolving geopolitical relationships, the familiar landscape of international commerce is shifting. These changes bring complexity – but also the chance to rethink how trade is financed and executed.

Historically, such disruption has driven innovation. Today, businesses are responding by expanding into new markets and diversifying partnerships. The redirection of trade flows from China toward Southeast Asia, Latin America, and Europe is a prime example. But this evolution isn’t just geographic – it’s digital at its core.

And central to this digital transformation is not simply the adoption of electronic documents, but the broader deployment of trade finance software – robust platforms that digitise, automate, and secure trade operations from origination to settlement.

Letters of credit (LCs), bills of lading, and other well-established trade instruments are making a strong comeback, especially as businesses venture into new and less familiar territories. But unlike in the past, these instruments are now embedded into advanced trade finance systems.

Take, for example, electronic bills of lading (eBLs). As highlighted by Steven Zhou, Executive Director at TradeGo during a recent Mitigram webinar, eBLs empower importers to maintain full control over goods in transit while facilitating instant, secure documentation workflows. But it’s not just about having digital documents – it’s about how trade finance platforms like Mitigram orchestrate these documents within a seamless workflow across banks, logistics providers, and trading partners.

Instead of shipping paper or static PDFs, trade finance software enables the creation, execution, and transfer of digital originals – reducing courier costs, eliminating document delays, improving liquidity, and boosting operational transparency.

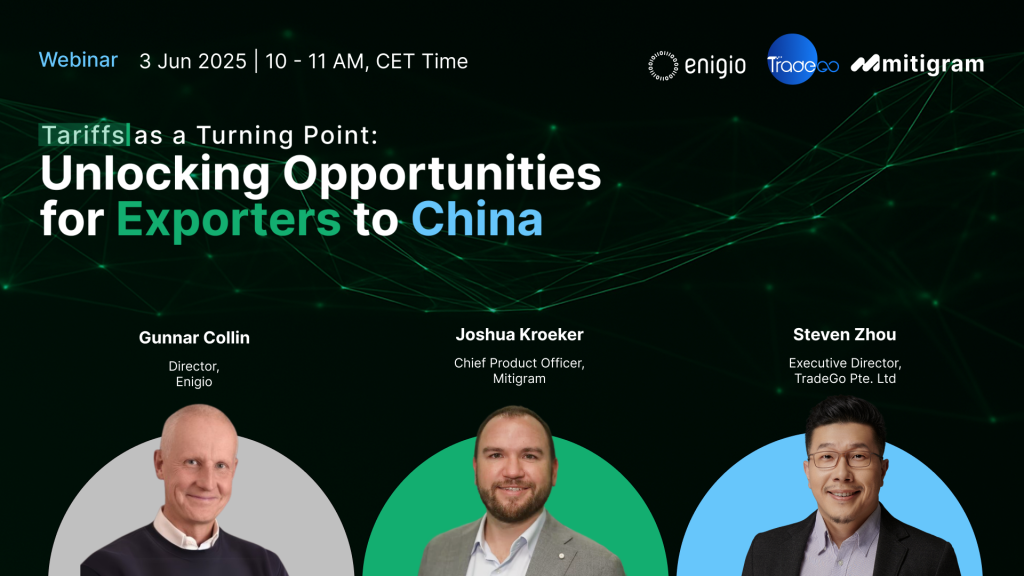

Recent webinar discussing the collaboration between Mitigram, Enigio and TradeGo.

Digitising trade isn’t just about adopting new technologies – it’s also about understanding the instruments that underpin global commerce. At Mitigram, we recognise that many companies, especially those entering new markets, may be unfamiliar with traditional trade finance tools like letters of credit (LCs), standby LCs, or guarantees.

To bridge this gap, we provide more than just a platform – we offer expert-led education and hands-on support. Through webinars, training sessions, and in-platform guidance, we help corporates and financial institutions understand when and how to use these instruments effectively. From structuring deals to complying with international standards, our team ensures clients feel confident navigating even the most complex trade finance scenarios.

By combining technology with education, Mitigram makes it easier for companies to not only digitise trade – but to do so with clarity, trust, and strategic insight.

Interoperability – the ability for different systems and platforms to work together – is emerging as a cornerstone of digital trade. As Gunnar Collin, Director at Enigio, noted during the webinar, legal frameworks like the Model Law on Electronic Transferable Records (MLETR) are being rapidly adopted. But ensuring compliance with such standards at scale requires more than document digitisation – it requires trade finance systems built for legal, technical, and operational interoperability.

Mitigram’s role in this ecosystem goes beyond enabling digital documents. It connects banks, corporates, and logistics providers through secure, legally compliant infrastructure. This collaboration across the ecosystem is essential. No single provider can digitise global trade alone – but software platforms can act as the glue that brings the entire chain together.

Digitising trade isn’t about swapping paper for PDFs. It’s about rethinking the process using platforms purpose-built for trade. Here’s how companies can begin:

What’s unfolding today is more than digitisation – it’s a systemic transformation. Trade finance software is not just enabling businesses to survive disruption, but to build entirely new trade corridors with agility and confidence.

With global adoption of enabling legal frameworks and increasing collaboration between regulators, financial institutions, and technology providers, the path forward is clear. Digital trade isn’t the future – it’s the present.

At the heart of this transformation is trade finance software – the engine powering the next era of global trade.

Your Exclusive Gateway to Trade Finance Insights, Networking, and Innovation.